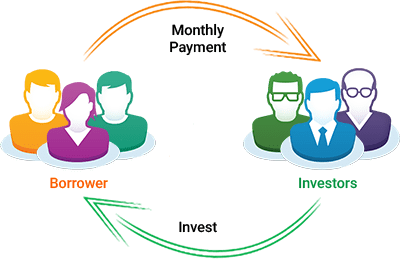

Biztech is a leading Peer to Peer platform in Jamaica

Biztech loan Marketplace aim to provide a solution where banks are unable to do so

Personal Loan at interest rates starting from 6%

Borrowers can get Personal loans at attractive interest rates as we go beyond Credit Score and assess their profile based on 60+ parameters using our proprietary psychometric test and credit score model.

BORROW NOW

Borrow Easily, Lend Safely

High Returns for Lenders up to 25% Ask about principal protection

On our platform, lenders can directly lend money to real people and earn high returns with principal protection in easy, secure and seamless manner, earlier only available through banks.

Lend NOW